In the world of investing, decision-making usually takes center stage. Every investor inevitably faces the question of where to invest: “Stocks or Forex?”. Both attract traders from all walks of life; offering unique benefits and carrying their own risks. At FishProvider, we aim to provide a clear understanding of both trading types to help you decide which might be appropriate for your investment goals.

Market Size & Liquidity

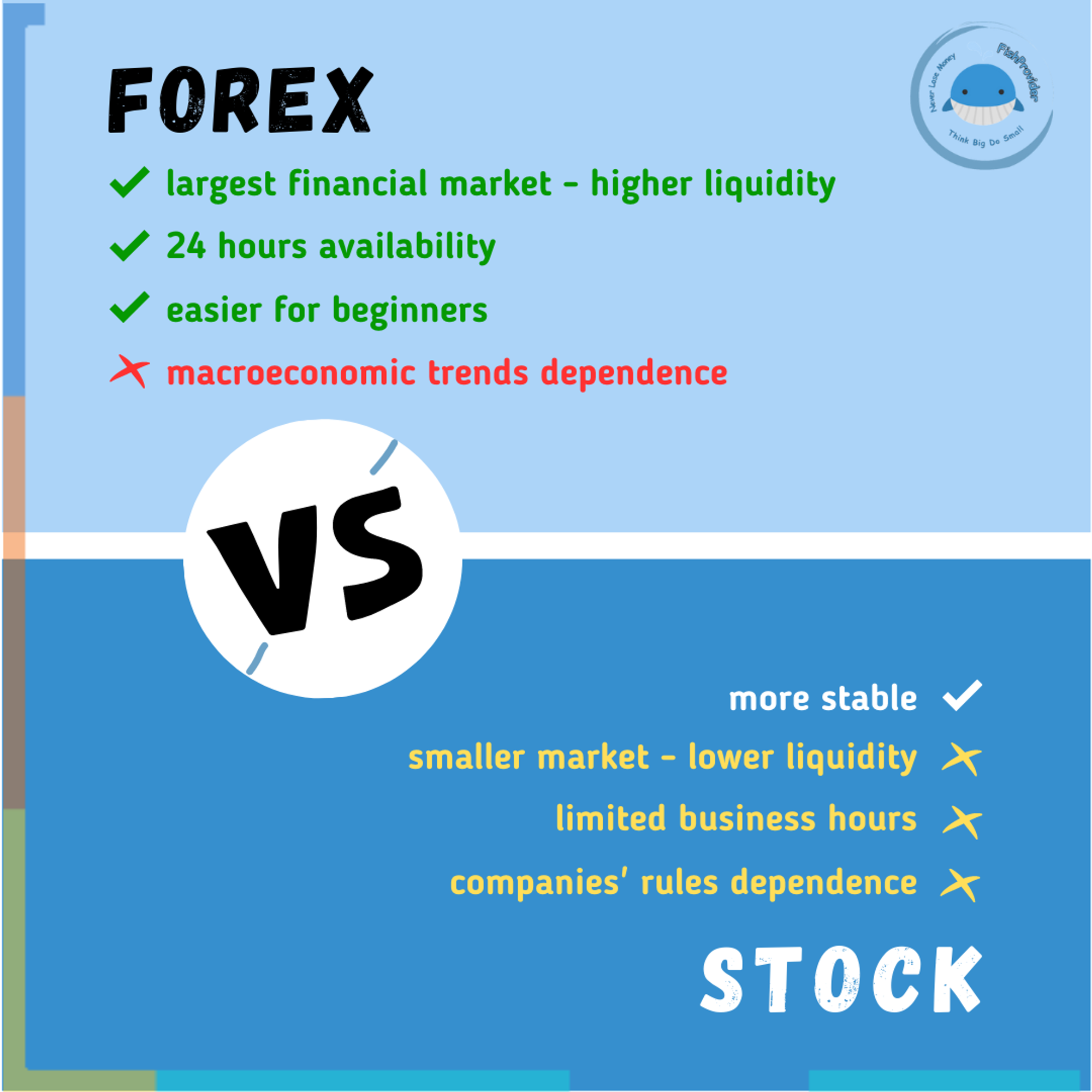

Starting with market size and liquidity, it's worth noting that the foreign exchange (Forex) market is the largest financial market worldwide. Its daily turnover exceeds $5 trillion, ensuring high liquidity. In contrast, the global stock market lags with an estimated volume of around $200 billion per day. What does this mean? With higher liquidity in Forex trading, investors have a better chance to buy or sell assets anytime they wish compared to limited standard business hours in individual stock markets.

Operating Times

Your lifestyle and schedule play into whether Forex or stocks are right for you too! Thanks to different international currencies traded across various time zones globally, Forex operates 24 hours a day–an attractive feature for those who want flexibility beyond traditional business hours offered by most national stock exchanges.

Volatility & Risk

Every form of investment comes with potential risks and rewards which can be intensified under particular volatility levels. Volatility in Forex arises mainly due to unexpected economic events affecting multiple countries' currencies. In contrast, the cause behind stock volatility can typically be traced back down directly towards earnings reports or managerial changes within individual companies. Forex may be more unpredictable given its wider perspective while Stocks could offer more stability yet respond sharply underneath company-specific news.

Level Of Access For Beginners

Interestingly enough, you don’t need excessive capital outlay in either form. However, with Forex allowing trades involving small lot sizes, it may present an easier entry point for beginners. Conversely, equity investments primarily blue chip shares could require significant upfront investment.

Influence From Economic Conditions And Global Events

Macroeconomic trends such as changes in interest rates, gross domestic product(GDP), and inflation contribute significantly towards currency fluctuations affecting forex trade. Meanwhile, single pieces regarding Mergers/acquisitions, and new contract partnerships involving specific companies readily shake up its share price. Thus, if deep analytical reviews come easy then Stocks would be your thing whereas forex being more dynamic requires constant attention paid forth on a global scale.

Possible Gains Vs Liquidity

With leverage, bigger positions can potentially create larger profits(or losses) especially inside mentioned often volatile environment posed by forex. Similarly though gains possible via equities shouldn’t underestimate completely apart from dividends reward long-term investors. Contingent upon risk tolerance one option could look appealing over another. Ultimately however effectual use of stop-loss/profit orders eliminates sudden surprises turning novice trader’s dream quick riches into nightmare substantial debt.

Deciding between forex versus stock trading depends greatly on an individual’s personal preferences, risk tolerance, knowledge, and resources. It stands important to recognize neither superior instead each possesses distinct characteristics that cater differently amongst investors. Remember careful analysis aided prudent risk management helps achieve outline specified investment goals irrespective path chosen!

Embarking onto an exciting journey remember it's essential to stay informed of ever-evolving challenges/opportunities presented ahead. The investment end game always sticks to preserving and enhancing wealth wisely constantly integrating learned lessons into future strategies!

Happy Trading!