Forex trading is an attractive and lucrative investment opportunity for people who want to generate passive income or diversify their investment portfolio. However, the world of currency trading can be daunting and time-consuming, especially for beginners. A reliable and profitable alternative to traditional trading is the Percentage Allocation Money Management (PAMM) system, a popular and innovative managed account service. In this blog, we will explore the ins and outs of a PAMM system, its advantages, risks, and the best practices to succeed in forex trading using a PAMM account.

What is a PAMM system?

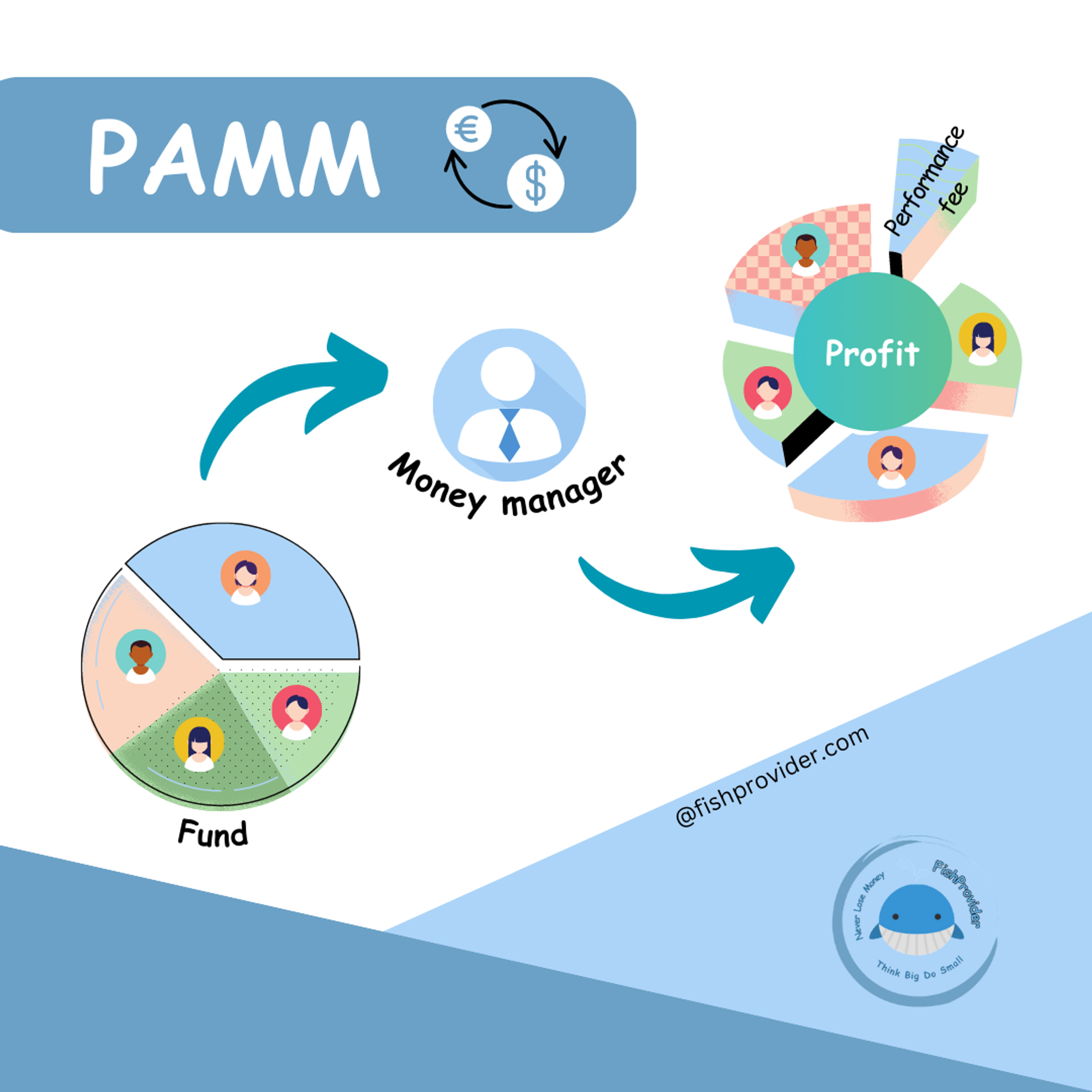

PAMM stands for Percentage Allocation Management Module, which is a pooled money management system where a group of investors entrusts their funds to a skilled and experienced forex trader, also known as a money manager. The money manager utilizes their market knowledge and trading skills to manage the funds collectively. The profits and losses are divided among the investors based on the percentage of their investment in the PAMM account.

How does a PAMM account work?

A PAMM system consists of three main participants: the investors, the money manager, and the broker. The investors deposit their funds into a PAMM account, which the money manager then uses to trade on the forex market. The PAMM account is managed by a broker who allocates the profits and losses among the investors according to their share in the account. The broker also ensures the smooth functioning of the PAMM system by providing the necessary technological infrastructure, trade execution, and customer support.

To become a part of the PAMM system, both investors and money managers need to open a PAMM account with a reliable broker. Once an investor finds a suitable money manager, they can allocate their funds to the money manager's PAMM account. The money manager then begins to trade on the forex market using the combined capital, aiming to maximize profits and minimize losses.

The money manager charges a performance fee for their services, typically a percentage of the profits generated. The fee structure and other terms, such as the minimum investment amount, are agreed upon by both parties before starting the PAMM system.

Advantages of using a PAMM system

1. Diversification: A PAMM account enables investors to diversify their investment portfolio, spreading risk across multiple trading strategies, currency pairs, and time zones.

2. Expertise: The PAMM system allows investors to capitalize on the expertise of experienced forex traders without the need to actually learn and execute trades themselves.

3. Time-saving: The PAMM system is especially suitable for investors who don't have the time to study the forex market and watch the constantly fluctuating exchange rates.

4. Transparent performance tracking: Most PAMM brokers provide an online platform where investors can track the performance of their PAMM accounts in real-time, ensuring full transparency of the investment process.

Risks associated with the PAMM system

Despite the potential benefits, the PAMM system has risks. The major risk is the performance of the money manager. If the money manager makes wrong decisions or cannot execute profitable trades consistently, it could lead to significant losses for the investors.

To mitigate this risk, it is essential to conduct thorough research on prospective money managers, reviewing their trading history and performance metrics. Another way to reduce risk is to diversify PAMM investments among multiple money managers with different trading strategies.

Best practices for success in PAMM Forex trading

1. Choose a reputable broker: To ensure the safety of your funds and efficient management of your PAMM account, select a reputable and regulated PAMM broker.

2. Research and select experienced money managers: Evaluate several money managers based on their performance history, trading strategies, and risk management techniques before making a decision.

3. Diversify investments: Spread your funds across multiple PAMM accounts managed by different money managers to mitigate the risk of potential losses.

4. Monitor performance: Keep a close eye on the performance of your PAMM account and be prepared to make changes to your portfolio by adding or removing money managers as needed.

The PAMM system provides forex investors with a unique opportunity to benefit from the expertise of experienced traders without dedicating significant time and effort to learning financial markets. With thorough research and proper risk management, a PAMM account can be an effective tool for generating passive income and diversifying your investment portfolio.

Happy Trading!